On 13 November 1997, a new casino opened its doors just south of North Carolina’s Great Smoky Mountains in the US. Despite the dismal weather, a long line had formed at the entrance, and as people continued to arrive by the hundreds, the casino boss began advising folks to stay at home.

Read this story in a minute.

The widespread interest was hardly surprising. After all, it wasn’t just some shifty, mafia-run gambling den opening its doors that day. Harrah’s Cherokee Resort was and still is a massive luxury casino owned and operated by the Eastern Band of Cherokee Indians, and its opening marked the end of a 10-year-long political tug-of-war. One tribal leader had even predicted that “gambling would be the Cherokees’ damnation”, and North Carolina’s governor had tried to block the project at every turn.

Soon after the opening, it became apparent that the casino would bring the tribe not damnation but relief. The profits – amounting to $150m in 2004 and growing to nearly $400m in 2010 – enabled the tribe to build a new school, hospital, and fire station. However, the lion’s share of the takings went directly into the pockets of the 8,000 men, women, and children of the Eastern Band Cherokee tribe. From $500 a year at the outset, members’ per capita earnings from the casino quickly mounted to $6,000 in 2001, making up a quarter to a third of the average family income.

As coincidence would have it, a Duke University professor by the name of Jane Costello had been researching the mental health of youngsters south of the Great Smoky Mountains since 1993. Every year, the 1,420 kids enrolled in her study took a psychiatric test. The cumulative results had already shown that those growing up in poverty were much more prone to behavioural problems than other children.

This wasn’t exactly news, though. Correlations between poverty and mental illness had been drawn before by another academic, Edward Jarvis, in his famous paper Report on Insanity in Massachusetts, published in 1855.

But the question still remained: which was the cause, and which the effect?

The chicken or the egg

At the time Costello was doing her research, it was becoming increasingly popular to attribute mental problems to individual genetic factors. If nature was the root cause, then handing over a sack of money every year would be treating the symptoms, but ignoring the disease. If, on the other hand, people’s psychiatric problems were not the cause but the consequence of poverty, then that $6,000 might genuinely work wonders. The arrival of the casino, Costello realised, presented a unique opportunity to shed new light on this ongoing question since a quarter of the children in her study belonged to the Cherokee tribe, more than half of them living below the poverty line.

Soon after the casino opened, Costello was already noting huge improvements for her subjects. Behavioural problems among children who had been lifted out of poverty went down 40%, putting them in the same range as their peers who had never known hardship. Juvenile crime rates among the Cherokee also declined, along with drug and alcohol use, while their school scores improved markedly. At school, the Cherokee kids were now on a par with the study’s non-tribal participants.

On seeing the data, Costello’s first reaction was disbelief. “The expectation is that social interventions have relatively small effects,” she later said. “This one had quite large effects.”

Costello calculated that the extra $4,000 per annum resulted in an additional year of educational attainment by age 21 and reduced the chance of a criminal record at age 16 by 22%.

Ten years after the casino’s arrival, Costello’s findings showed that the younger the age at which children escaped poverty, the better their mental health when they were teenagers. Among her youngest age cohort, Costello observed a “dramatic decrease” in criminal conduct. In fact, the Cherokee children in her study were now better behaved than the control group.

What, then, is the cause of mental health problems among poorer people? Nature or culture? The conclusion was both

But the most significant improvement was in how the money helped parents, well, to parent. Before the casino opened its doors, parents worked hard through the summer but were often jobless and stressed in the winter. The new income enabled Cherokee families to put money aside and to pay bills in advance. Parents who were lifted out of poverty now reported having more time for their children.

They weren’t working any less though, Costello discovered. Mothers and fathers alike were putting in just as many hours as before the casino opened. More than anything, said tribe member Vickie L Bradley, the money helped ease the pressure on families, so the energy they’d spent worrying about money was now freed up for their children. And as Bradley put it, that “helps parents be better parents”.

What, then, is the cause of mental health problems among poorer people? Nature or culture? Costello’s conclusion was both: the stress of poverty puts people genetically predisposed to develop an illness or disorder at an elevated risk. But there’s a more important takeaway from this study.

Genes can’t be undone. Poverty can.

Why poor people do foolish things

A world without poverty – it might be the oldest utopia around.

But anybody who takes this dream seriously must inevitably face a few tough questions. Why are poor people more likely to commit crimes? Why are they more prone to obesity? Why do they use more alcohol and drugs? In short, why do the poor make so many poor decisions?

Harsh? Perhaps, but take a look at the statistics: the poor borrow more, save less, smoke more, exercise less, drink more, and eat less healthfully. Offer money management training and poor people are the last to sign up. When responding to job ads, they often write the worst applications and show up at interviews in the least professional attire.

Margaret Thatcher, the former British prime minister, once called poverty a “personality defect.” Though not many politicians would go quite so far, this view that the solution resides with the individual is not exceptional. From Australia to England and from Sweden to the United States, there is an entrenched notion that poverty is something people have to overcome on their own. Sure, the government can nudge them in the right direction with incentives – with policies promoting awareness, with penalties, and, above all, with education. In fact, if there’s a perceived silver bullet in the fight against poverty, it’s a high-school diploma (or even better, a college degree).

But is that all there is to it?

What if the poor aren’t actually able to help themselves? What if all the incentives, all the information and education are like water off a duck’s back? And what if all those well-meant nudges only make the situation worse?

The power of context

These are harsh questions, but then, it’s not just anybody asking them; it’s Eldar Shafir, a psychologist at Princeton University. He and Sendhil Mullainathan, an economist at Harvard, published a revolutionary theory on poverty in 2013.

The gist? It’s the context, stupid.

Shafir isn’t modest in his aspirations. He wants nothing less than to establish a whole new field of science: the science of scarcity. But don’t we have that already? Economics? “We get that a lot,” laughs Shafir when I meet with him at a hotel in Amsterdam. “But my interest is in the psychology of scarcity, on which surprisingly little research has been done.”

To economists, everything revolves around scarcity – after all, even the biggest spenders can’t buy everything. However, the perception of scarcity is not ubiquitous. An empty schedule feels different to a jam-packed workday. And that’s not some harmless little feeling. Scarcity impinges on your mind. People behave differently when they perceive a thing to be scarce.

What that thing is doesn’t much matter. Whether it’s too little time, money, friendship, food – it all contributes to a “scarcity mentality”. And this has benefits. People who experience a sense of scarcity are good at managing their short-term problems. Poor people have an incredible ability – in the short term – to make ends meet, the same way that overworked CEOs can power through to close a deal.

You can’t take a break from poverty

Despite all this, the drawbacks of a “scarcity mentality” are greater than the benefits. Scarcity narrows your focus to your immediate lack – to the meeting that’s starting in five minutes, or the bills that need to be paid tomorrow. The long-term perspective goes out the window. “Scarcity consumes you,” Shafir explains. “You’re less able to focus on other things that are also important to you.”

Compare it to a new computer that’s running 10 heavy programmes at once. It gets slower and slower, makes errors, and eventually freezes – not because it’s a bad computer but because it has to do too much at once. Poor people have an analogous problem. They’re making bad decisions not because they are stupid but because they’re living in a context in which anyone would make bad decisions.

Scarcity narrows your focus to your immediate lack – to the meeting that’s starting in five minutes, or the bills that need to be paid tomorrow

Questions such as "What’s for dinner?" and "How will I make it to the end of the week?" tax a crucial capacity.

“Mental bandwidth,” Shafir and Mullainathan call it. “If you want to understand the poor, imagine yourself with your mind elsewhere,” they write. “Self-control feels like a challenge. You are distracted and easily perturbed. And this happens every day.” This is how scarcity – whether of time or of money – leads to unwise decisions.

There’s a key distinction though between people with busy lives and those living in poverty: you can’t take a break from poverty.

Just how much does poverty affect intelligence?

“Our effects correspond to between 13 and 14 IQ points,” Shafir says. “That’s comparable to losing a night’s sleep or the effects of alcoholism.” What’s remarkable is that we could have figured all this out 30 years ago. Shafir and Mullainathan weren’t relying on anything so complicated as brain scans. “Economists have been studying poverty for years and psychologists have been studying cognitive limitations for years. We just put two and two together.”

It all started a few years ago with a series of experiments conducted at a typical US mall. Shoppers were stopped to ask what they would do if they had to pay to get their car fixed. Some were presented with a $150 repair job, others with one costing $1,500. Would they pay it all in one go, get a loan, work overtime, or put off the repairs?

While the mall-goers were mulling it over, they were subjected to a series of cognitive tests. In the case of the less expensive repairs, people with a low income scored about the same as those with a high income. But faced with a $1,500 repair job, poor people scored considerably lower. The mere thought of a major financial setback impaired their cognitive ability.

Shafir and his fellow researchers corrected for all possible variables in the mall survey, but there was one factor they couldn’t resolve: the rich folks and the poor folks questioned weren’t the same people. Ideally, they’d be able to repeat the survey with subjects who were poor at one moment and rich the next.

Shafir found what he was looking for some 8,000 miles away in the districts of Vilupuram and Tiruvannamalai in rural India. The conditions were perfect. As it happened, the area’s sugarcane farmers collect 60% of their annual income all at once right after the harvest. This means they are flush one part of the year and poor the other.

So how did they do in the experiment?

At the time when they were comparatively poor, they scored substantially worse on the cognitive tests. Not because they had become less intelligent people somehow – they were still the same Indian sugarcane farmers, after all – but purely and simply because their mental bandwidth was compromised.

How giving money away actually saves money

“Fighting poverty has huge benefits that we have been blind to until now,” Shafir points out. In fact, he suggests, in addition to measuring our gross domestic product, maybe it’s time we also started considering our gross domestic mental bandwidth. Greater mental bandwidth equates to better child-rearing, better health, more productive employees – you name it. “Fighting scarcity could even reduce costs,” he says.

And that’s precisely what happened south of the Great Smoky Mountains. Randall Akee, an economist at the University of Los Angeles, calculated that the casino cash distributed to Cherokee kids ultimately cut expenditures. According to his conservative estimates, eliminating poverty actually generated more money than the total of all casino payments through reductions in crime, use of care facilities, and repetition of school grades.

So what can be done?

Shafir and Mullainathan have a few possible solutions up their sleeves: giving needy students a hand with all that financial aid paperwork, for instance, or providing pill boxes that light up to remind people to take their meds. This type of solution is called a “nudge”. Nudges are hugely popular with politicians, mostly because they cost next to nothing.

The casino cash distributed to Cherokee kids ultimately cut expenditures ... eliminating poverty actually generated more money than all casino payments

But, honestly, what difference can a nudge really make? The nudge epitomises an era in which politics is concerned chiefly with combatting symptoms. Nudges might serve to make poverty infinitesimally more bearable, but when you zoom out, you see that they solve exactly nothing. Going back to our computer analogy, I ask Shafir: why keep tinkering around with the software when you could easily solve the problem by installing some extra memory instead?

Shafir responds with a blank look. “Oh! You mean just hand out more money? Sure, that would be great,” he laughs and mentions the evident limitations of introducing such a policy in the United States.

Granted, it would take a big programme to eradicate poverty in the US. According to economist Matt Bruenig’s calculations, it would cost $175bn. But poverty is even more expensive. One study estimated the cost of child poverty at as much as $500bn a year. Kids who grow up poor end up with two years’ less education, work 450 fewer hours per year, and run three times the risk of bad health than those raised in families that are well off.

Investments in education won’t really help these kids, the researchers say. They have to get above the poverty line first. A 2013 meta-analysis of 201 studies on the effectiveness of financial education came to a similar conclusion: such education makes almost no difference at all. This is not to say no one learns anything – poor people can come out wiser, for sure. But it’s not enough. “It’s like teaching a person to swim and then throwing them in a stormy sea,” laments Shafir.

It doesn’t have to be this way.

“Poverty is a great enemy to human happiness; it certainly destroys liberty, and it makes some virtues impracticable, and others extremely difficult,” said the British essayist Samuel Johnson in 1782. Unlike many of his contemporaries, he understood that poverty is not a lack of character.

It’s a lack of cash.

Adapted from Rutger’s book, Utopia for Realists: and How We Can Get There.

Translated from the Dutch by Elizabeth Manton and Erica Moore.

Not a member of The Correspondent yet?

The Correspondent is a member-funded, online platform for independent, ad-free journalism. Choose what you want to pay to become a member today!

Not a member of The Correspondent yet?

The Correspondent is a member-funded, online platform for independent, ad-free journalism. Choose what you want to pay to become a member today!

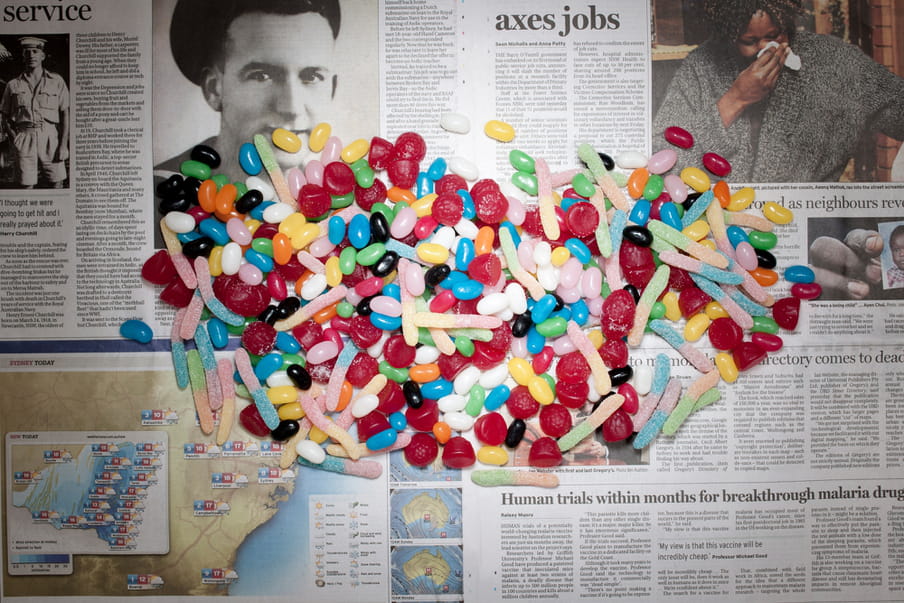

About the images

The Poverty Line is an ongoing project by photographer-economist duo Stefen Chow and Huiyi Lin. Between 2010 and 2020, they travelled to 36 countries to create images illustrating the daily budgets of those living in poverty. The captions provide the amount of money that people in a given country have to spend on a daily basis, as well as the amount that is left for food after all the other expenses are deducted. The images show the amount of food that can be bought for the amount that’s left over. With local newspapers as backdrops, the images are a depiction of life on the breadline in different cultural contexts, inviting the viewer to imagine a life under such difficult circumstances. (Isabelle van Hemert, image editor)

About the images

The Poverty Line is an ongoing project by photographer-economist duo Stefen Chow and Huiyi Lin. Between 2010 and 2020, they travelled to 36 countries to create images illustrating the daily budgets of those living in poverty. The captions provide the amount of money that people in a given country have to spend on a daily basis, as well as the amount that is left for food after all the other expenses are deducted. The images show the amount of food that can be bought for the amount that’s left over. With local newspapers as backdrops, the images are a depiction of life on the breadline in different cultural contexts, inviting the viewer to imagine a life under such difficult circumstances. (Isabelle van Hemert, image editor)

Dig deeper

Watch Rutger’s Ted Talk on why we need universal basic income

Poverty isn’t a lack of character. It’s a lack of cash.

Watch Rutger’s Ted Talk on why we need universal basic income

Poverty isn’t a lack of character. It’s a lack of cash.

Why we can be hopeful about criminal justice in the US (even if it still jails the most people)

Though progress remains slow, the costs of tough-on-crime policies are prompting change.

Why we can be hopeful about criminal justice in the US (even if it still jails the most people)

Though progress remains slow, the costs of tough-on-crime policies are prompting change.