There are those who say this pandemic shouldn’t be politicised. That doing so is tantamount to basking in self-righteousness. Like the religious hardliner shouting it’s the wrath of God, or the populist scaremongering about the “Chinese virus”, or the trend-watcher predicting we’re finally entering a new era of love, mindfulness, and free money for all.

There are also those who say now is precisely the time to speak out. That the decisions being made at this moment will have ramifications far into the future. Or, as Obama’s chief of staff put it after Lehman Brothers fell in 2008: “You never want a serious crisis to go to waste.”

In the first few weeks, I tended to side with the naysayers. I’ve written before about the opportunities crises present, but now it seemed tactless, even offensive. Then more days passed. Little by little, it started to dawn that this crisis might last months, a year, even longer. And that anti-crisis measures imposed temporarily one day could well become permanent the next.

No one knows what awaits us this time. But it’s precisely because we don’t know because the future is so uncertain, that we need to talk about it.

The tide is turning

On 4 April 2020, the British-based Financial Times published an editorial likely to be quoted by historians for years to come.

The Financial Times is the world’s leading business daily and, let’s be honest, not exactly a progressive publication. It’s read by the richest and most powerful players in global politics and finance. Every month, it puts out a magazine supplement unabashedly titled “How to Spend It” about yachts and mansions and watches and cars.

But on this memorable Saturday morning in April, that paper published this:

“Radical reforms – reversing the prevailing policy direction of the last four decades – will need to be put on the table. Governments will have to accept a more active role in the economy. They must see public services as investments rather than liabilities, and look for ways to make labour markets less insecure. Redistribution will again be on the agenda; the privileges of the elderly and wealthy in question. Policies until recently considered eccentric, such as basic income and wealth taxes, will have to be in the mix.”

What’s going on here? How could the tribune of capitalism suddenly be advocating for more redistribution, bigger government, and even a basic income?

For decades, this institution stood firmly behind the capitalist model of small government, low taxes, limited social security – or at most with the sharpest edges rounded off. “Throughout the years I’ve worked there,” responded a journalist who has written for the paper since 1986, “the Financial Times has advocated free market capitalism with a human face. This from the editorial board sends us in a bold new direction.”

The ideas in that editorial didn’t just appear out of blue: they’ve travelled a very long distance, from the margins to the mainstream. From anarchist tent cities to primetime talk shows; from obscure blogs to the Financial Times.

And now, in the midst of the biggest crisis since the second world war, those ideas might just change the world.

To understand how we got here, we need to take a step back in history. Hard as it may be to imagine now, there was a time – some 70 years ago – that it was the defenders of free market capitalism who were the radicals.

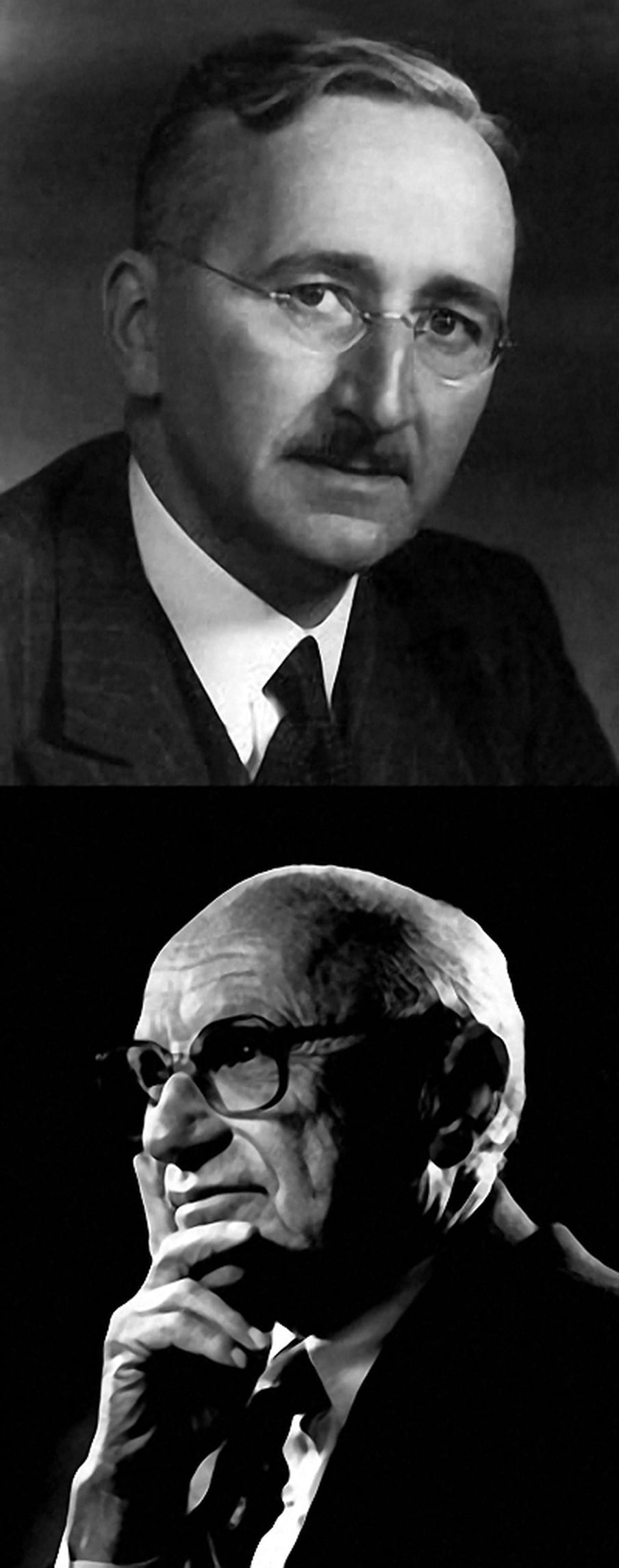

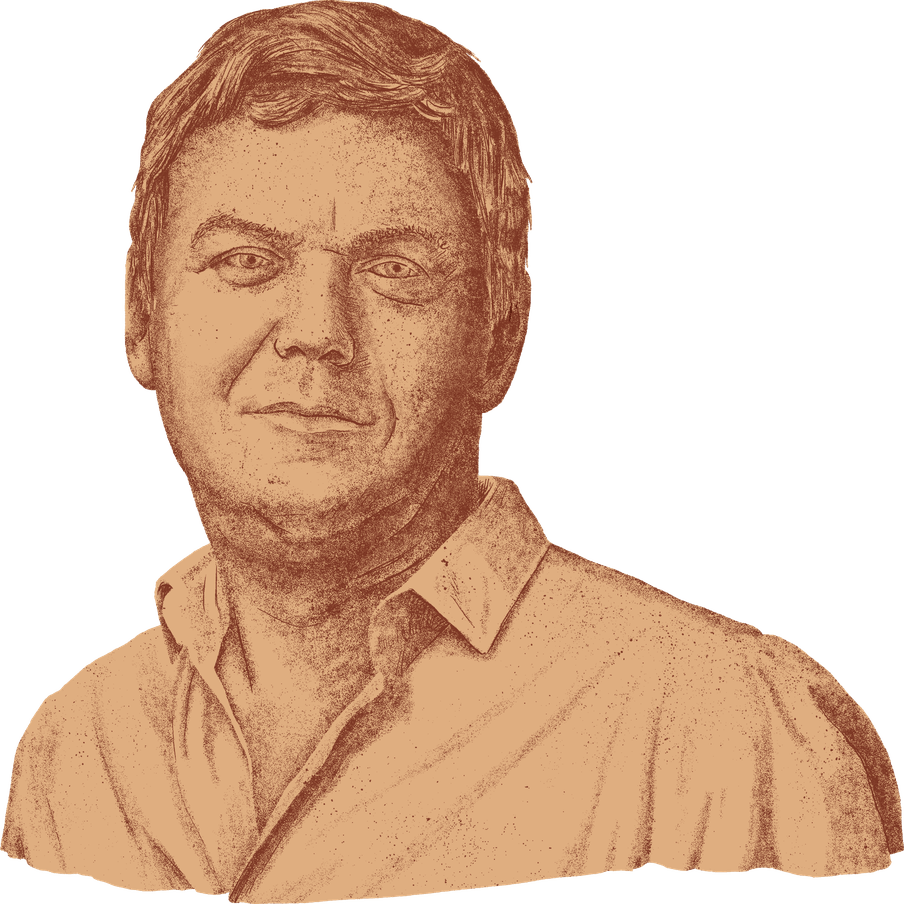

In 1947, a small think tank was established in the Swiss village of Mont Pèlerin. The Mont Pèlerin Society was made up of self-proclaimed “neoliberals”, men like the philosopher Friedrich Hayek and the economist Milton Friedman.

In those days, just after the war, most politicians and economists espoused the ideas of John Maynard Keynes, British economist and champion of a strong state, high taxes, and a robust social safety net. The neoliberals by contrast feared growing states would usher in a new kind of tyranny. So they rebelled.

The members of the Mont Pèlerin Society knew they had a long way to go. The time it takes for new ideas to prevail “is usually a generation or even more,” Hayek noted, “and that is one reason why … our present thinking seems too powerless to influence events.”

Friedman was of the same mind: “The people now running the country reflect the intellectual atmosphere of some two decades ago when they were in college.” Most people, he believed, develop their basic ideas in their teens. Which explained why “the old theories still dominate what happens in the political world”.

Friedman was an evangelist of free-market principles. He believed in the primacy of self-interest. Whatever the problem, his solution was simple: out with government; long live business. Or rather, government should turn every sector into a marketplace, from healthcare to education. By force, if necessary. Even in a natural disaster, competing companies should be the ones to take charge of organising relief.

Friedman knew he was a radical. He knew he stood far afield of the mainstream. But that only energised him. In 1969, Time magazine characterised the US economist as “a Paris designer whose haute couture is bought by a select few, but who nonetheless influences almost all popular fashions”.

Hard as it may be to imagine now, there was a time when the defenders of free market capitalism were the radicals

Crises played a central role in Friedman’s thinking. In the preface to his book Capitalism and Freedom (1982), he wrote the famous words:

“Only a crisis – actual or perceived – produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around.”

The ideas that are lying around. According to Friedman, what happens in a time of crisis all depends on the groundwork that’s been laid. Then, ideas once dismissed as unrealistic or impossible might just become inevitable.

And that’s exactly what happened. During the crises of the 1970s (economic contraction, inflation, and the Opec oil embargo), the neoliberals were ready and waiting in the wings. “Together, they helped precipitate a global policy transformation,” sums up historian Angus Burgin. Conservative leaders like US president Ronald Reagan and UK prime minister Margaret Thatcher adopted Hayek and Friedman’s once-radical ideas, and in time so did their political adversaries, like Bill Clinton and Tony Blair.

One by one, state-owned enterprises the world over were privatised. Unions were curtailed and social benefits were cut. Reagan claimed the nine most terrifying words in the English language were “I’m from the government, and I’m here to help”. And after the fall of communism in 1989, even social democrats seemed to lose faith in government. In his State of the Union address in 1996, Clinton, president at the time, pronounced “the era of big government is over”.

Neoliberalism had spread from think tanks to journalists and from journalists to politicians, infecting people like a virus. At a dinner in 2002, Thatcher was asked what she saw as her great achievement. Her answer? “Tony Blair and New Labour. We forced our opponents to change their minds.”

And then came 2008.

On 15 September, the US bank Lehman Brothers unchained the worst financial crisis since the Great Depression. When massive government bailouts were needed to save the so-called “free” market, it seemed to signal the collapse of neoliberalism.

And yet, 2008 did not mark a historic turning point. One country after another voted down its leftwing politicians. Deep cuts were made to education, healthcare, and social security even as gaps in equality grew and bonuses on Wall Street soared to record heights. At the Financial Times, an online edition of luxury lifestyle magazine How to Spend It was launched a year after the crash.

Where the neoliberals had spent years preparing for the crises of the 1970s, their challengers now stood empty-handed. Mostly, they just knew what they were against. Against the cutbacks. Against the establishment. But a programme? It wasn’t clear enough what they were for.

Now, 12 years later, crisis strikes again. One that’s more devastating, more shocking, and more deadly. According to the British central bank, the United Kingdom is on the eve of the largest recession since the winter of 1709. In the space of just three weeks, nearly 17 million people in the United States applied for economic impact payments. In the 2008 financial crisis, it took two whole years for the country to reach even half that number.

Unlike the 2008 crash, the coronavirus crisis has a clear cause. Where most of us had no clue what "collateralised debt obligations" or "credit default swaps" were, we all know what a virus is. And whereas after 2008 reckless bankers tended to shift the blame to debtors, that trick won’t wash today.

But the most important distinction between 2008 and now? The intellectual groundwork. The ideas that are lying around. If Friedman was right and a crisis makes the unthinkable inevitable, then this time around history may well take a very different turn.

Three dangerous French economists

“Three Far-Left Economists Are Influencing The Way Young People View The Economy And Capitalism,” headlined a far-right website in October 2019. It was one of those low-budget blogs that excel in spreading fake news, but this title about the impact of a French trio of economists hit the nail right on the head.

I remember the first time I came across the name of one of those three: Thomas Piketty. It was the fall of 2013 and I was browsing around economist Branko Milanović’s blog as I often did because his scathing critiques of colleagues were so entertaining. But in this particular post, Milanović abruptly took a very different tone. He’d just finished a 970-page tome in French and was singing its praises. It was, I read, “a watershed in economic thinking”.

Milanović had long been one of the few economists to take any interest at all in researching inequality. Most of his colleagues wouldn’t touch it. In 2003, Nobel Laureate Robert Lucas had even asserted that research into questions of distribution was “the most poisonous” to “sound economics”.

Meanwhile, Piketty had already started his groundbreaking work. In 2001, he published an obscure book with the first-ever graph to plot the income shares of the top 1%. Together with fellow economist Emmanuel Saez – number two of the French trio – he then demonstrated that inequality in the United States is as high now as it was back in the roaring twenties. It was this academic work that would inspire the rallying cry of Occupy Wall Street: “We are the 99%.”

In 2014, Piketty took the world by storm. The professor became a “rock-star economist” – to the frustration of many (with the Financial Times mounting a frontal attack). He toured the world to share his recipe with journalists and politicians. The main ingredient? Taxes.

That brings us to the specialty of number three of the French trio, the young economist Gabriel Zucman. On the very day Lehman Brothers fell in 2008, this 21-year-old economics student started a traineeship at a French brokerage firm. In the months that followed, Zucman had a front row seat to the collapse of the global financial system. Even then, he was struck by the astronomical sums flowing through small countries like Luxembourg and Bermuda, the tax havens where the world’s super-rich hide their wealth.

Within a couple of years, Zucman became one of the world’s leading tax experts. In his book The Hidden Wealth of Nations (2015), he worked out that $7.6tn of the world’s wealth is hidden in tax havens. And in a book co-authored with Emmanuel Saez, Zucman calculated that the 400 richest US Americans pay a lower tax rate than every single other income group, from plumbers to cleaners to nurses to retirees.

The young economist doesn’t need many words to make his point. His mentor Piketty released another doorstopper in 2020 (coming in at 1,088 pages), but Zucman and Saez’s book can be read in a day. Concisely subtitled “How the Rich Dodge Taxes and How to Make Them Pay,” it reads like a to-do list for the next US president.

The most important step? Pass an annual progressive wealth tax on all multimillionaires. Turns out, high taxes need not be bad for the economy. On the contrary, high taxes can make capitalism work better. (In 1952, the highest income tax bracket in the United States was 92%, and the economy grew faster than ever.)

Five years ago, these kinds of ideas were still considered too radical to touch. Former president Obama’s financial advisers assured him a wealth tax would never work, and that the rich (with their armies of accountants and lawyers) would always find ways to hide their money. Even Bernie Sanders’s team turned down the French trio’s offers to help design a wealth tax for his 2016 presidential bid.

But 2016 is an ideological eternity away from where we are now. In 2020, Sanders’s “moderate” rival Joe Biden is proposing tax increases double what Hillary Clinton planned four years ago. These days, the majority of US voters (including Republicans) are in favour of significantly higher taxes on the super-rich. Meanwhile, across the pond, even the Financial Times concluded that a wealth tax might not be such a bad idea.

Beyond champagne socialism

“The problem with socialism,” Thatcher once quipped, “is that you eventually run out of other people’s money.”

Thatcher touched on a sore spot. Politicians on the left like talking taxes and inequality, but where’s all the money supposed to come from? The going assumption – on both sides of the political aisle – is that most wealth is “earned” at the top by visionary entrepreneurs, by men like Jeff Bezos and Elon Musk. This turns it into a question of moral conscience: shouldn’t these titans of the Earth share some of their wealth?

If that’s your understanding, too, then I’d like to introduce you to Mariana Mazzucato, one of the most forward-thinking economists of our times. Mazzucato belongs to a generation of economists, predominantly women, who believe merely talking taxes isn’t enough. “The reason progressives often lose the argument,” Mazzucato explains, “is that they focus too much on wealth redistribution and not enough on wealth creation.”

In recent weeks, lists have been published all over the world of what we’ve started calling “essential workers”. And surprise: jobs like “hedge fund manager” and “multinational tax consultant” appear nowhere on those lists. All of a sudden, it has become crystal clear who’s doing the truly important work in care and in education, in public transit and in grocery stores.

In 2018, two Dutch economists did a study leading them to conclude that a quarter of the working population suspect their job is pointless. Even more interesting is that there are four times more “socially pointless jobs” in the business world than in the public sphere. The largest number of these people with self-professed "bullshit jobs" are employed in sectors like finance and marketing.

This brings us to the question: where is wealth actually created? Media like the Financial Times have often claimed – like their neoliberal originators, Friedman and Hayek – that wealth is made by entrepreneurs, not by states. Governments are at most facilitators. Their role is to provide good infrastructure and attractive tax breaks – and then to get out of the way.

But in 2011, after hearing the umpteenth politician sneeringly call government workers “enemies of enterprise”, something clicked in Mazzucato’s head. She decided to do some research. Two years later, she’d written a book that sent shockwaves through the policymaking world. Title: The Entrepreneurial State.

In her book, Mazzucato demonstrates that not only education and healthcare and garbage collection and mail delivery start with the government, but also real, bankable innovations. Take the iPhone. Every sliver of technology that makes the iPhone a smartphone instead of a stupidphone (internet, GPS, touchscreen, battery, hard drive, voice recognition) was developed by researchers on a government payroll.

And what applies to Apple applies equally to other tech giants. Google? Received a fat government grant to develop a search engine. Tesla? Was scrambling for investors until the US Department of Energy handed over $465m. (Elon Musk has been a grant guzzler from the start, with three of his companies – Tesla, SpaceX, and SolarCity – having received a combined total of almost $5bn in taxpayer money.)

“The more I looked,” Mazzucato told tech magazine Wired last year, “the more I realised: state investment is everywhere.”

True, sometimes the government invests in projects that don’t pay off. Shocking? No: that’s what investment’s all about. Enterprise is always about taking risks. And the problem with most private “venture” capitalists, Mazzucato points out, is that they’re not willing to venture all that much. After the Sars outbreak in 2003, private investors quickly pulled the plug on coronavirus research. It simply wasn’t profitable enough. Meanwhile, publicly funded research continued, for which the US government paid a cool $700m. (If and when a vaccine comes, you have the government to thank for that.)

But maybe the example that best makes Mazzucato’s case is the pharmaceutical industry. Almost every medical breakthrough starts in publicly funded laboratories. Pharmaceutical giants like Roche and Pfizer mostly just buy up patents and market old medicines under new brands, and then use the profits to pay dividends and buy back shares (great for driving up stock prices). All of which has enabled annual shareholder payments by the 27 biggest pharmaceutical companies to multiply fourfold since 2000.

If you ask Mazzucato, that needs to change. When government subsidises a major innovation, she says industry is welcome to it. What’s more, that’s the whole idea! But then the government should get its initial outlay back – with interest. It’s maddening that right now the corporations getting the biggest handouts are also the biggest tax evaders. Corporations like Apple, Google, and Pfizer, which have tens of billions tucked away in tax havens around the world.

There’s no question these companies should be paying their fair share in taxes. But it’s even more important, according to Mazzucato, that the government finally claims the credit for its own achievements. One of her favourite examples is the 1960s Space Race. In a 1962 speech, former president Kennedy declared “We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard.”

In this day and age, we also face tremendous challenges that call for an enterprising state’s unparalleled powers of innovation. For starters, one of the most pressing problems ever to confront the human species: climate change. Now more than ever, we need the mentality glorified in Kennedy’s speech to achieve the transformation necessitated by climate change. It’s no accident then that Mazzucato, alongside British-Venezuelan economist Carlota Perez, became the intellectual mother of the Green New Deal, the world’s most ambitious plan to tackle climate change.

Another of Mazzucato’s friends, US economist Stephanie Kelton, adds that governments can print extra money if needed to fund their ambitions – and not to worry about national debts and deficits. (Economists like Mazzucato and Kelton don’t have much patience for old-school politicians, economists, and journalists who liken governments to households. After all, households can’t collect taxes or issue credit in their own currency.)

What we’re talking about here is nothing less than a revolution in economic thinking. Where the 2008 crisis was followed by severe austerity, we’re now living at a time when someone like Kelton (author of a book tellingly titled The Deficit Myth) is hailed by none other than the Financial Times as a modern-day Milton Friedman. And when that same paper wrote in early April that government “must see public services as investments rather than liabilities”, it was echoing precisely what Kelton and Mazzucato have contended for years.

But maybe the most interesting thing about these women is that they’re not satisfied with mere talk. They want results. Kelton for example is an influential political adviser, Perez has served as a consultant to countless companies and institutions, and Mazzucato too is a born networker who knows her way around the world’s institutions.

Not only is she a regular guest at the World Economic Forum in Davos (where the world’s rich and powerful convene every year), the Italian economist has also advised the likes of senator Elizabeth Warren and congresswoman Alexandria Ocasio-Cortez in the US and Scottish first minister Nicola Sturgeon. And when the European Parliament voted to pass an ambitious innovation programme last year, that too was drafted by Mazzucato.

“I wanted the work to have an impact,” the economist remarked drily at the time. “Otherwise it’s champagne socialism: you go in, talk every now and then, and nothing happens.”

How ideas conquer the world

How do you change the world?

Ask a group of progressives this question and it won’t be long before someone says the name Joseph Overton. Overton subscribed to Milton Friedman’s views. He worked for a neoliberal think tank and spent years campaigning for lower taxes and smaller government. And he was interested in the question of how things that are unthinkable become, in time, inevitable.

Imagine a window, said Overton. Ideas that fall inside this window are what’s deemed “acceptable” or even “popular” at any given time. If you’re a politician who wants to be re-elected, you’d better stay inside this window. But if you want to change the world, you need to shift the window. How? By pushing on the edges. By being unreasonable, insufferable, and unrealistic.

In recent years, the Overton Window has undeniably shifted. What once was marginal is now mainstream. A French economist’s obscure graph became the slogan of Occupy Wall Street (“We are the 99%”); Occupy Wall Street paved the way for a revolutionary presidential candidate, and Bernie Sanders pulled other politicians like Biden in his direction.

These days, more young US Americans have a favourable view of socialism than of capitalism – something that would have been unthinkable 30 years ago. (In the early 1980s, young voters were the neoliberal Reagan’s biggest support base.)

But didn’t Sanders lose the primaries? And didn’t the socialist Jeremy Corbyn suffer a dramatic election defeat just last year in the UK?

Certainly. But election results aren’t the only sign of the times. Corbyn may have lost the 2017 and 2019 elections, but Conservative policy wound up much closer to the Labour Party’s financial plans than to their own manifesto.

Similarly, though Sanders ran on a more radical climate plan than Biden in 2020, Biden’s climate plan is more radical than that Sanders had in 2016.

Thatcher wasn’t being facetious when she called “New Labour and Tony Blair” her greatest achievement. When her party was defeated in 1997, it was by an opponent with her ideas.

Changing the world is a thankless task. There’s no moment of triumph when your adversaries humbly acknowledge you were right. In politics, the best you can hope for is plagiarism. Friedman had already grasped this in 1970, when he described to a journalist how his ideas would conquer the world. It would play out in four acts:

“Act I: The views of crackpots like myself are avoided.

Act II: The defenders of the orthodox faith become uncomfortable because the ideas seem to have an element of truth.

Act III: People say, ‘We all know that this is an impractical and theoretically extreme view – but of course we have to look at more moderate ways to move in this direction.’

Act IV: Opponents convert my ideas into untenable caricatures so that they can move over and occupy the ground where I formerly stood.”

Still, if big ideas begin with crackpots, that doesn’t mean every crackpot has big ideas. And even though radical notions occasionally get popular, winning an election for once would be nice as well. Too often, the Overton Window is used as an excuse for the failures of the left. As in: “At least we won the war of ideas.”

Many self-proclaimed “radicals” have only half-formed plans for gaining power, if they have any plans at all. But criticise this and you’re branded a traitor. In fact, the left has a history of shifting blame onto others – onto the press, the establishment, sceptics within their own ranks – but it rarely shoulders responsibility itself.

Just how hard it is to change the world was brought home to me yet again by the book Difficult Women, which I read recently during lockdown. Written by British journalist Helen Lewis, it’s a history of feminism in Great Britain, but ought to be required reading for anyone aspiring to create a better world.

By “difficult”, Lewis means three things:

- It’s difficult to change the world. You have to make sacrifices.

- Many revolutionaries are difficult. Progress tends to start with people who are obstinate and obnoxious and deliberately rock the boat.

- Doing good doesn’t mean you’re perfect. The heroes of history were rarely as squeaky clean as they’re later made out to be.

Lewis’s criticism is that many activists appear to ignore this complexity, and that makes them markedly less effective. Look at Twitter, which is rife with people who seem more interested in judging other tweeters. Yesterday’s hero is toppled tomorrow at the first awkward remark or stain of controversy.

Lewis shows there are a lot of different roles that come into play in any movement, often necessitating uneasy alliances and compromises. Like the British suffrage movement, which brought together a whole host of “Difficult Women, from fishwives to aristocrats, mill girls to Indian princesses”. That complex alliance survived just long enough to achieve the victory of 1918, granting property-owning women over age 30 the right to vote.

(That’s right, initially only privileged women got the vote. It proved a sensible compromise, because that first step led to the inevitability of the next: universal suffrage for women in 1928.)

And no, even their success could not make all those feminists into friends. Anything but. According to Lewis, “Even the suffragettes found the memory of their great triumph soured by personality clashes.”

Progress, it turns out, is complicated.

The way we conceive of activism tends to forget the fact that we need all those different roles. Our inclination – in talk shows and around dinner tables – is to choose our favourite kind of activism: we give Greta Thunberg a big thumbs up but fume at the road blockades staged by Extinction Rebellion. Or we admire the protesters of Occupy Wall Street but scorn the lobbyists who set out for Davos.

That’s not how change works. All of these people have roles to play. Both the professor and the anarchist. The networker and the agitator. The provocateur and the peacemaker. The people who write in academic jargon and those who translate it for a wider audience. The people who lobby behind the scenes and those who are dragged away by the riot police.

One thing is certain. There comes a point when pushing on the edges of the Overton Window is no longer enough. There comes a point when it’s time to march through the institutions and bring the ideas that were once so radical to the centres of power.

I think that time is now.

The ideology that was dominant these last 40 years is dying. What will replace it? Nobody knows for sure. It’s not hard to imagine this crisis might send us down an even darker path. That rulers will use it to seize more power, restrict their populations’ freedom, and stoke the flames of racism and hatred.

But things can be different. Thanks to the hard work of countless activists and academics, networkers and agitators, we can also imagine another way. This pandemic could send us down a path of new values.

If there was one dogma that defined neoliberalism, it’s that most people are selfish. And it’s from that cynical view of human nature that all the rest followed – the privatisation, the growing inequality, and the erosion of the public sphere.

Now a space has opened up for a different, more realistic view of human nature: that humankind has evolved to cooperate. It’s from that conviction that all the rest can follow – a government based on trust, a tax system rooted in solidarity, and the sustainable investments needed to secure our future. And all this just in time to be prepared for the biggest test of this century, our pandemic in slow motion – climate change.

Nobody knows where this crisis will lead us. But compared to the last time, at least we’re more prepared.

This article was translated from Dutch by Elizabeth Manton. You can also read the Dutch version of this article.

Correction: in the photo of Reagan, the adviser pictured is Alan Greenspan, not Paul McCracken as previously stated.

Not a member of The Correspondent yet?

The Correspondent is a member-funded, online platform for collaborative, constructive, ad-free journalism. Choose what you want to pay to become a member today!

Not a member of The Correspondent yet?

The Correspondent is a member-funded, online platform for collaborative, constructive, ad-free journalism. Choose what you want to pay to become a member today!

Dig deeper

The global financial system is collapsing. Here’s a three-step plan to take back control

The health of our domestic economies and the planet is tied to market forces that are largely invisible and little understood. As Covid-19 shakes the foundations of the world economy, rather than hope to restore it, let’s work to replace it.

The global financial system is collapsing. Here’s a three-step plan to take back control

The health of our domestic economies and the planet is tied to market forces that are largely invisible and little understood. As Covid-19 shakes the foundations of the world economy, rather than hope to restore it, let’s work to replace it.

Outgrowing growth: why quality of life, not GDP, should be our measure of success

Mainstream economics still thinks growth is essential, but this blind belief in GDP is just enriching the rich and killing the planet. We don’t need more growth to improve people’s lives. By working less, buying and producing less, and investing in public services, we can improve quality of life – and fight the climate crisis.

Outgrowing growth: why quality of life, not GDP, should be our measure of success

Mainstream economics still thinks growth is essential, but this blind belief in GDP is just enriching the rich and killing the planet. We don’t need more growth to improve people’s lives. By working less, buying and producing less, and investing in public services, we can improve quality of life – and fight the climate crisis.